Long-Term Care Protection

Most of us will need long-term care (LTC) at some point, and the costs can be steep.

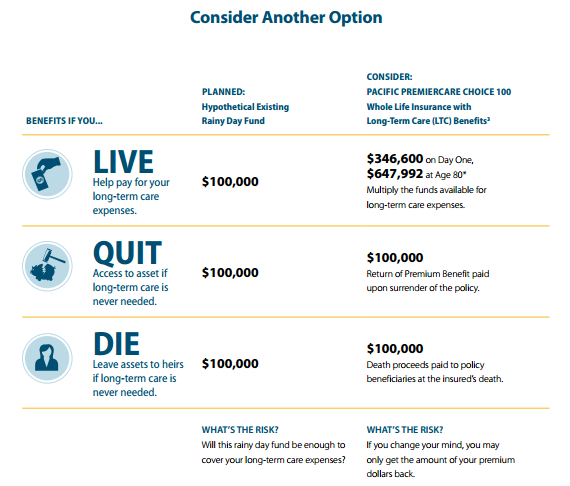

If you need long-term care, will the rainy day fund you’ve set aside be sufficient to meet the rising costs of long-term care services?

Many people think they’ve saved sufficiently for long-term care costs, but in reality, they may not be prepared. Here are some average long-term care costs:

$132,900 is the average annual cost for a private room in a skilled nursing facility

$4,946 is the average monthly cost of a private, one-bedroom unit in a residential care facility.

$24.15 is the average hourly rate for a certified home health aide provided by a home healthcare agency.

What if you could keep the features you like most about self-insuring but use a vehicle that may better help you cover your long-term care costs?

Embrace the Concept of Leverage

If you plan to self-insure, each dollar you’ve saved will pay for just one dollar of long-term care services. But by re-positioning a portion of your current assets into a better vehicle, you may leverage the dollars you’ve saved for greater long-term care protection.

This greater protection begins on day one of the policy.

Contact us today for more information

925-693-9912

info@imcinsurance.com